Owner Experience Strategy: Home Appliances for Modern Families

CLIENT:

LG

RELATIONSHIP:

Agency, freelance

PROJECT DURATION:

3 Months

OBJECTIVE:

Define a north-star vision for visual design, product strategy, and content strategy for post-purchase experience at LG, including owner accounts and product support. How can we evolve from owner accounts to member accounts? What can we infuse from adjacent brands who are succeeding in this space?

RESULTING IMPACT:

Our studies enabled robust recommendations across product strategy, content strategy, and visual design for MyLG Account and Support. The updated experiences are currently rolling out on LG North America digital properties. These foundational insights were used to create user personas for the client team, which are used in the centralized Ownership Experience and Support teams at LG.

TEAM:

LG: Program Director, Product Owner, UX Lead, + 7 Additional Stakeholders from LG

Agency: Director of Product Strategy, Design Director, Product Manager, Product Designer, Senior Product Designer, User Research Lead (myself)

RESPONSIBILITIES:

I led end-to-end strategic research, including sample definition, live moderation, survey design and facilitation, and competitor research to inform the ramped Account and Support experiences.

FOUNDATIONAL QUALITATIVE INTERVIEWS

First, I worked with the LG client team to define the recruitment criteria for our foundational qualitative study, and I facilitated recruitment through a third-party vendor. Together, we aligned on the following study design and learning goals.

METHODOLOGY DETAILS

Method: A blind qualitative study of moderated user interviews with a total of (n=21) appliance owners

Session Duration: 60 minutes

Time in-field: 2 weeks

Key Screener Criteria:

50% LG owners and 50% non-LG owners to ensure generative outputs.

At least two major products or appliances within the last 18 months.

An even mix of owners with smart and non-smart appliances.

Additional screener criteria included HHI, gender, employment, and popular US demographics for LG.

LEARNING OBJECTIVES

Connected Appliances:

How do expectations for the owner account differ for owners with connected vs. non-connected appliances?

Shopping & Registration:

How does registration & suppport play a part in shopping? What values resonate in the context of brand loyalty?

Getting Support & Membership:

Paid and/or unpaid— what entices you?

Engagement & Utility

How do we make owning an LG product a joyful experience and continue to make owners feel special?

KEY QUALITATIVE INSIGHTS 💡

Our foundational qualitative study unearthed 4 major theme areas, 9 key insights, and 3 key learnings I surfaced with LG. We made recommendations for new product strategy & new content strategy to improve the value of registration and the LG owner account & the Support offerings from an owner perspective.

We identified three unique dispositions toward connected appliances

Owners pay attention to brands’ appetite for social good, and how products impact both the environment and their own bills.

We identified key value propositions for account creation and product registration.

We found initial validation for community-based support, where owners can self-service with the help of other product owners.

From here, we turned to quantitative methods to scale our findings and help prioritize our product & content strategies.

QUANTITATIVE RESEARCH

Next, I designed a survey to scale our insights and learnings and prioritize the different opportunities we identified in our qualitative research. This helped us answer what is most meaningful to current and future owners.

METHODOLOGY DETAILS

Method: We completed a general population survey with a sample of (n=1035) home electronics and appliance owners aged 25-60 and located across the United States.

Duration: Our survey efforts unfolded over the course of ~1 month

Key Screener Criteria: Our screener included 11 demographic and behavioral questions.

50% of participants owned at least one LG appliance and 50% owned no LG appliances

All participants made a major appliance purchase within the last 18 months.

Household income was above 100K for all participants.

LEARNING OBJECTIVES

Connected Appliances

Are the 3 dispositions distinct scaled groups worthy of tailored content strategies?

Shopping & Registration

Of those identified through qual research, what’s the most compelling incentive for registration and account creation?

Getting Support & Membership

What can we learn about how Support can be improved from an owner perspective?

Product & Content Strategy

Do they want to see the product as a lifestyle match?

KEY QUANTITATIVE LEARNINGS 💡

I presented insights and learnings from our four key theme areas with the LG client team to help them prioritize their approach to product strategy & content strategy for myLG.

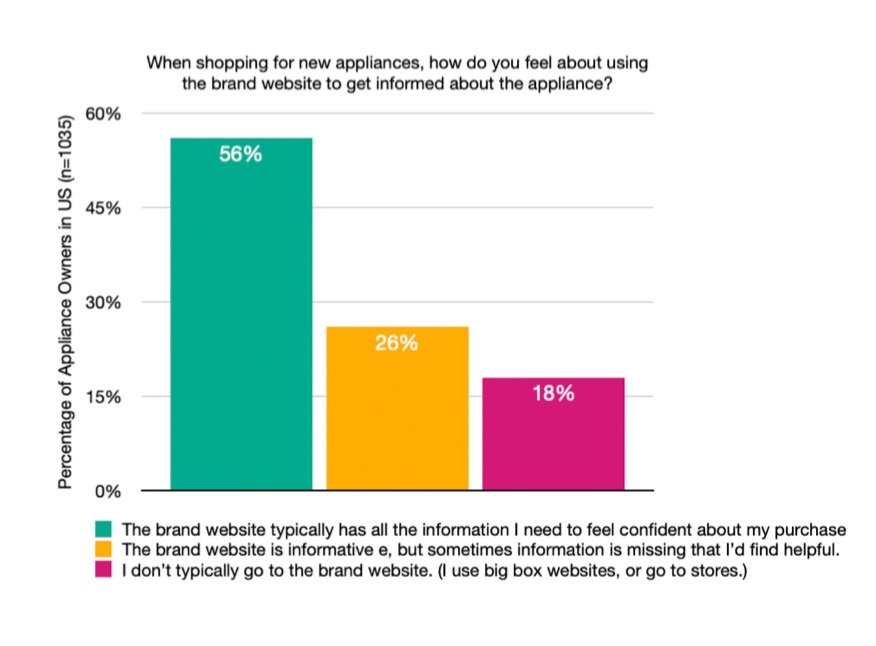

Shopping & Registration Needs

While we heard in qualitative research that the brand website is sometimes lacking relevant information, we found a concrete need to fill the gaps. We also identified the strongest value propositions for product registration.

Connected Home Appliances

Most critically, we validated our three distinct user types from qualitative research, and recommended to develop different content strategies for each group. We also confirmed that owners tended to mix appliance brands in their home, with only 10% intent on maintaining brand cohesion.

Support Behaviors & Needs

We confirmed the primary behaviors for seeking technical help for initial technical help, along with the best formatting for this type of information. We also learned that a whopping 80% of owners have crowdsourced help from owners of the same product, indicating a strong appetite for community engagement.

Product & Content Strategy Insights

Owners are especially turned into whether or not a product is a lifestyle match. I recommended take a more relational approach to digital strategy vs. the product focused approach that has become standard at LG. We also prioritized social causes that buyers identify with, so a a content strategy could be built out accordingly.

COMPETITOR RESEARCH

For our last phase of research and in the interest of speed, I leveraged unmoderated user interviews via Usertesting.com to evaluate (1) the owner account and (2) support experience offered by LG and the defined competitor brands.

Key Screener Criteria, All Studies:

Participants must have purchased from the brand being evaluated within the last 18 months, and registered it via the brand website.

All participants must be located within the US, aged 25-60, with a household income above $100K.

METHODOLOGY DETAILS: Track One, Study One

Approach: This track consisted of 20 participants, each of whom engaged 1 of 5 brands in isolation.

Key Tasks: Tell us about their recent purchase and describe and rate their satisfaction with the product, then, walk us through using the website to get product support, and rate the experience in terms of ease of use

METHODOLOGY DETAILS: Track One, Study Two

Approach: This track consisted of 16 participants who compared experiences from LG & one competitor.

Key Tasks: Share feedback on the product support hubs for LG and one competitor brand, and rate them for overall visual design and organization, then share feedback on a product support page from LG and one competitor brand, and rate them for intuitiveness and ease of use

METHODOLOGY DETAILS, Track Two

Approach: This track consisted of 30 users, each of whom viewed 1 of 5 brands in isolation

Key Tasks: Users are asked to locate the account space on the brand website and tell us what this space is for, then, to access it, and tell us how it aligns with their expectations. How do they conceive of this space? Secondly, they were asked to describe the account space from a visual design perspective, and tell us how about how intuitive the page feels, ease of use, and reasons for coming here.

KEY COMPETITOR LEARNINGS 💡

Altogether, we were able to hone in on design elements from each brand that were working well, and infuse them into our revamped experience.

Owners found LG’s support pages to be more visually overwhelming, but found value in the vastness of topics offered even without obvious organization.

Apple has standardized a product support journey, surfacing common topics at the top, followed by set up, maximizing value via product tips, and troubleshooting article topics.

Bose leveraged an icon carousel that filters topics accordingly, sure to surface most visited topics relevant to that category.

Samsung uses visual search in their product hub with optional text search, while LG relies on the model or serial number.

RESULTING IMPACT

Our three studies enabled robust recommendations across product strategy, content strategy, and visual design for MyLG Account and Support experiences. The updated Support & Ownership Experiences are currently rolling out on LG North America digital properties.

As a secondary outcome, these foundational insights were also used to create user personas for the client team, which are used in the centralized Ownership Experience team and Support teams.

Get in touch.

Curious about coaching or interested in collaborating? Schedule an introduction using the big yellow button, send a message using this form, or email me directly at joseph@violet-studio.com. You can also connect with me on LinkedIn.