DESIGN RESEARCH DIRECTOR 💡

Joseph Ramsawak

DESIGNING NIMBLE INSIGHTS STRATEGIES TO UNLOCK NEW LEVELS OF HUMAN-CENTRICITY

CASE STUDY 001

Using Qualitative Data to Demystify Product Metrics & Drive Design Strategy

Client: The New York Times

Relationship: In-house contractor

Sector: Subscription Media

Responsibilities: User research & strategy, design strategy

Objective: Gather data to better understand how users move through the existing subscription flow, and make sense of observed drop-off in A/B test metrics

Project duration: 2 Weeks

Approach: I used unmoderated user research via Usertesting.com to identify the problem and packaged my findings with relevant competitor examples, as well as my own concept design for how to improve the user experience.

BUSINESS PROBLEM

After implementing the social sign-up API, creative teams wondered how to drive Home Delivery Subscription conversion by leveraging an exquisitely art directed experience.

They partnered with the Optimization teams to A/B test this awesome art directed experience (A) against the existing zip-code entry experience (B), and observed a 34% lift, but 20% depression upon reaching social sign-up.

EVALUATIVE RESEARCH 💡

I designed an unmoderated evaluative study of the landing pages, using custom staging links provided by the Optimization team.

Our original study design assumed that all incoming traffic to the landing pages was coming from within the NYT digital properties, but after stakeholders confirmed the large number of readers coming from directly from Search, I thought it better to expand our scope as follows.

METHODOLOGY DETAILS

Method: Unmoderated evaluative study with (n=20)

Session Duration / Time in-field: 35 minutes / 1 week

Key Screener Criteria:

Participants were subscribed to at least one news publication

Participants reported an openness to paying for home delivery

ABRIDGED LEARNING GOALS

How do we explain the drop-off at social sign-up? How are the expectations set up by the different landing pages being tested?

On the whole, do users comprehend daily options for subscirption? Or do they simply think Home Delivery is only available on Sundays?

What are the strengths and weaknesses of each page here?

EVALUATIVE LEARNINGS

Our most impactful learnings revealed the universal expectation to pay before creating account, and the need to tidy up Home Delivery Subscription links online. We also gathered rich learnings around (1) the art-directed landing page, (2) the existing control landing page, as well as (3) the experience of coming from search vs. coming from within the NYT properties.

The control version of the landing page got praise for simplicity, but some readers noted it was not aligned with the polished experience of NYT, whether in print or digital. The complexity of two pathways (one for Sunday and another to select your days of the week) was a bit overwhelming, and some completely missed the array of daily delivery combinations. While coming from search did not necessarily change perception, we identified an abundance of outdated links that needed to be cleared in order to ensure readers end up in the right place.

RESULT 💡

My recommendations were to resolve the broken links appearing on Google search results, and to implement a progress bar to guide readers along the subscription process.

To bolster my report and findings, I took a look at some The Washington Post & Wired to see how they approached the subscription experience, and presented these reference points along with a simple solution I put together myself.

Wired’s Subscription Experience

Washington Post Subscription Experience

My design solution for the Subscription Progress Bar

My design recommendations were quickly applied to the Home Delivery subscription flow, and the progress bar was also extended to digital-only subscriptions as well.

After following up with the team, we found that the unexplained drop-off had normalized, and overall conversion rate was better sustained through the social sign-up screen, and the resources dedicated to solving this initial quandary were reallocated to new business problems.

CASE STUDY 002

Using Data to Redirect: Research-Fueled Design Sprint for New Feature Development

Client: Pinger, Inc.

Relationship: In-house, full-time researcher

Sector: A2P Communications, Mobile CRM Startup

Responsibilities: User research & strategy, design sprint facilitation, usability testing

Objective: Validate an in-development feature before it’s too late, and advise on next steps

Project duration: 6 months

Approach: When I joined a second phone number startup called Pinger in 2019 as the founding user researcher, I led a round of introductory stakeholder interviews with core and executive team members. I chose a qualitative research study to validate that we’re solving an actual user problem. When research did not support the feature, I used scaled learnings to prove the case for redirection, facilitated a design sprint for an alternative feature, and led usability rounds to polish and support the feature through production.

EVALUATIVE PROTOTYPE TEST

I designed a moderated prototype test with a cross-section of business users to understand how this feature resonates with business from different verticals, partnering with data teams to identify engaged users and recruit them to my study via intercept outreach.

METHODOLOGY DETAILS

Research Approach: We conducted a moderated prototype test with (n=16) Sideline business users

Session Duration / Time in-field: 45 minutes / 1.5 weeks

Key Screener Criteria:

Sideline business users who were intercepted from the pre-existing bucket

Users from a range of professions, i.e. realtors, hairstylists, home maintenance, insurance sales, fitness coach, web designer etc.

EVALUATIVE INSIGHTS

Research revealed low-confidence in the in-progress Outreach feature, and I recommended we move away from this feature.

We learned that SMS is not the primary mode of communication for some business who opt to leverage email instead. Business struggled to cite use cases aside from the templated text shown in the prototype, and found the experience to be less personalized than they were expecting, and users may have clients with distinct or unique needs. Still, many saw value in one-to-many messaging, but with a manual approach instead of automation. They had explicit notions of the different types of lists and message templates they would create, expressing strong excitement at that prospect.

Still, key stakeholders remained skeptical of the findings given the “smaller” research sample size. In order to build confidence at the executive level, I turned to scaled survey learnings to bolster the case for redirecting feature development efforts.

QUANTITATIVE RESEARCH

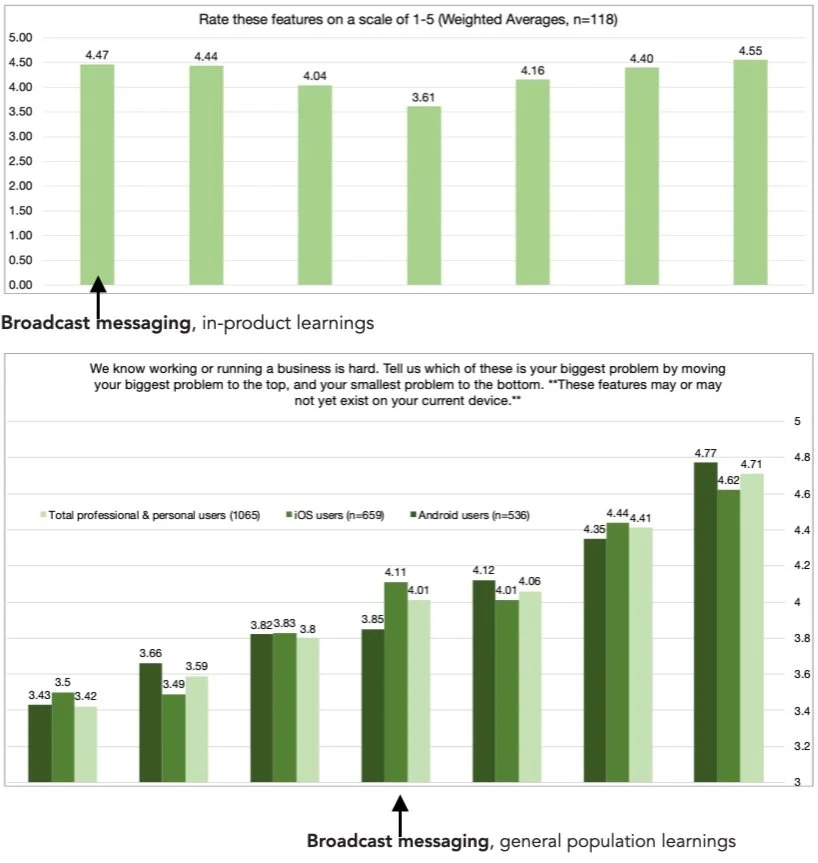

Next, I designed a survey study to drive our confidence in our evaluative research findings, and learn how to invest organizational efforts in serving business users. We assessed possible new features as well, including a simplified one-to-many messaging experience dubbed “Broadcast" based what we learned from our initial evaluative study.

I leveraged two survey methods—an in-product survey leveraging internal tools, and a general population survey using SurveyMonkey to boost our confidence in pursuing a new direction—to ensure our findings extend beyond our product.

METHODOLOGY DETAILS

In-Product Survey Method: We fielded questions to all users in the pre-existing bucket of (~500 users), yielding (n=120) responses.

General Population Survey Method: We obtained learnings from (n=1065) business owners with a second phone number to validate at scale and outside of our product

Key Screener Criteria:

All subjects must have a second phone number which is used for business purposes

ABRIDGED LEARNING GOALS

Key Tasks, In-Product Survey:

Assess the existing features in the bucket and assess needs for possible future features

Rate new feature statements framed as user problems

Are users finding new features useful?

Key Tasks, General Population Survey.

Rank new feature statements framed as user problems, including the revised broadcast messaging feature

Gather some validation for another nascent project

KEY QUANTITATIVE INSIGHTS 💡

Our survey results supported our initial recommendation to pursue alternate needs, as the value proposition for Broadcast outperformed the value proposition for Outreach across in-product and general population surveys.

For our in-product survey, broadcast messaging was rated the most important need after caller-ID and spam blocking.

In our general population survey, broadcast messaging ranked fourth after must-have features such as search.

RESULT 💡

With these scaled learnings reinforcing my initial recommendation, there was a mindset shift in the company that we should abandon the Outreach feature, that was too automated and de-personalized for small business users.

Instead, we’d pivot toward Broadcast messaging, which had appeal from a range of business verticals and resonated conceptually inside and outside of our product’s user base.

USABILITY TESTING AND VALIDATION

Our core product team delved into sprint mode based on the above learnings. Together we brainstormed, conceptualized, built and polished a prototype to validate inside and outside of our user base, and to evaluate usability before moving to development.

METHODOLOGY DETAILS

Method: We usability tested the new broadcast feature with (n=5) non-users from target verticals, including one realtor, two hair stylists, one massage therapist, and one LMFT. We then tested with another (n=4) users intercepted from our product to validate among our existing users.

Key Screener Criteria:

All participants had been using a second phone number to run their business.

Key Questions:

Can users locate the feature?

Can they access the list? What types of lists might you create?

What use cases exist aside from the templated message shown?

Do they comprehend how the message is displayed in Inbox?

RESULT 💡

Users were able to successfully locate the feature and use it, and exhibited strong comprehension as to how the messages were being displayed in the app. The new experience passed our usability evaluation, and the recommendation was to move toward production.

We captured visual feedback on the tool-tip experience that informed the final build, and moved forward to learn more about the needs for lists, templates, and other capabilities that would make this experience worthwhile (and worth paying for.)

As the first project untaken at a new company, this project immediately proved the value of user research to stakeholders from all departments. Executives were a big fan of the research-fueled design sprint that led to Broadcast Messaging, and replicated this process several times over my tenure to bring new features to life. From a financial perspective, moving away from Outreach as a flagship feature for Sideline Pro saved the company $10M or 3 months of company resources for a feature that didn’t meet user needs from a human-centered design perspective.

CASE STUDY 003

Inclusive Design Research: Co-Creating an Environment of Belonging for Black Viewership

Client: Disney+

Relationship: Agency

Sector: Streaming, Entertainment

Responsibilities: Co-creation design & facilitation, inclusive sampling, live moderation, synthesis & reporting

Objective: Advise Disney+ on inclusion & belonging strategies in content development, delivery, and discovery, and define north-star vision for cultivating an authentic user experience for Black viewers

Project duration: 8 weeks

Approach: In the fall of 2021, I designed and led 16 co-creation sessions with Black viewers from across the diaspora to shape product & UX principles in service of Black viewers. I was contracted by the primary agency to bring expertise in inclusive design research, facilitation and storytelling sprint-style engagement, and led synthesis with internal teams to distill a north-star vision for Disney+ in their approach to growing and sustaining Black viewership in an honest and authentic way.

BUSINESS CHALLENGE

In the wake of social media backlash to their “problematic content warning”, Disney+ executives took steps to invest in understanding their diverse audiences, starting with Black viewers.

How does inclusivity inform brand choices for Black viewers?

How do Black viewers perceive brands’ efforts to course correct after taking actions that negatively impact the community?

How can the business respond to needs of Black viewers to create a better environment of belonging?

What identity-specific needs remain unmet?

CO-CREATION SESSIONS

I designed and led a research study using co-creation sessions to probe deeply on different subcultures within the Black diaspora, and understand content and brand patronage through various lenses of Black identity. I incorporated an inclusive sampling protocol, DEIB principles and facilitation techniques, based on current DEI praxis and philosophy.

METHODOLOGY DETAILS

Method: We conducted live & remote 16 co-creation sessions with Disney+ users, maintaining and blind study to ensure generative discovery outputs. We used Miro to facilitate our exercises and create artifacts from our sessions.

Pre-work: We used users to bring artifacts to the session from brands they patron and content they’re watching, and to journal their thoughts on their engagement with brands for themselves and from a familial perspective.

Session Duration: 90 minutes

Time in-field: 2.5 weeks

Key Screener Criteria:

Users must have been subscribed to Disney+ and at least two additional streaming platforms.

We ensured a mix of family sizes to understand how parents make choices for their children and themselves.

A mix of diasporic groups, including descendants of enslaved people, African immigrants, Caribbean immigrants, and people of mixed race

We used open ended questions to ensure participants had thought through these topics prior to this engagement.

RESULT

We uncovered 7 insights regarding identity-based needs for Black viewers, grounded in behaviors, needs and desires for more inclusive streaming content and platforms.

We also identified 16 dimensions for Black viewers that are salient in selecting, watching, and resonating with content and their respective platforms, including Mood, Social Exchange, and Generational Lens.

Lastly, we collected 30+ jobs-to-be-done to help our client hone in on improvement opportunities to content and the platform. These were not only tactical jobs such as “I want to know how I will be charged,” but also more emotional jobs, such as “I want to safely and confidently entertain my family.”

We presented findings to Disney+ stakeholders within and beyond their UXR organization, and received positive, high-value feedback. Disney+ signed on for both additional phases with the agency to prioritize the new jobs-to-be-done, as well as additional projects to facilitate similar research with more identity-based groups.

CASE STUDY 004

Innovation Strategy for Smart TVs: How to Drive a Competitive Edge in a Homogenous Marketplace

Client: LG

Relationship: Agency

Sector: Home Electronics & Connected Devices

Responsibilities: Foundational strategic research, live moderation, design sprint facilitation, new product discovery & concepting

Objective: Identify net-new user experiences that add value for TV owners and increase long-term value from an owner relationship perspective

Project duration: 3 Months

Approach: I led a series of stakeholder interviews to articulate our challenge, and designed a nimble research engagement to address each challenge.

I designed a generative, foundational qualitative study to demystify smart TV and device usage in the home, and identify unmet needs for TV owners.

I built confidence in (most of) our insights and findings, and prioritized the most valuable solutions for LG smart TV owners who want more from their TV.

Then, I led a design sprint to produce these emergent solutions, and structured iterative concept testing to refine and polish them for handoff.

BUSINESS CHALLENGE

Can we develop a robust understanding of smart TV owner behaviors? How can we anticipate their emerging needs?

What innovative opportunities exist for net-new mobile UX? Are there unmet needs that translate to increased loyalty and additional purchases?

Can we design, test and refine concepts for those new experiences?

FOUNDATIONAL QUALITATIVE INTERVIEWS

I designed a generative, foundational qualitative study to demystify smart TV and device behaviors in the home, and identify unmet needs for TV owners. We targeted personas from existing LG paradigms, and I collaborated with the client to align on the following study goals and criteria.

METHODOLOGY DETAILS

Method: A blind, generative, qualitative study of live user interviews with a total of (n=21) smart TV owners

Session Duration / Time in-field: 60 minutes / 2 weeks

Key Screener Criteria:

50% LG TV owners, 50% owners of other TV brands, who purchased at least one TV within the last two years

Participants had a mix of streaming devices and smart systems such as Alexa and Ring.

Participants reflected persona types already established at LG.

Additional screener criteria included HHI, gender, employment, and popular US demographics for LG.

ABRIDGED LEARNING OBJECTIVES

Home Layout, Inventory:

Why do owners adopt the different smart devices in their homes?

Smart TVs & Streaming Media Players:

Why do owners adopt SMPs? How do they discover new content?

Multi-tasking with the Smart TV:

How does TV use factor into different parts of daily life, such as facilitating hobbies or other interests?

Future & Unmet Needs:

What do you expect smart TV to do next? Are there unmet, activity-specific needs?

FOUNDATIONAL INSIGHTS

We uncovered 4 major theme areas, 6 key insights, and 4 additional learnings that we surfaced with the client. We also identified 12 data-informed opportunities for compelling net-new UX, as well as 40+ jobs-to-be-done related to smart TV usage at home, bucketed into 6 major super jobs.

From here, we turned to quantitative methods to scale our findings, and prioritize areas of focus for our net-new concepts.

QUANTITATIVE RESEARCH

I designed a survey to prioritize and build confidence in the opportunities and needs gathered through qualitative research. This helped us determine which experiences would be most worthwhile for TV owners. At this point, I onboarded a freelancer to drive our survey analysis, and I facilitated our survey deployment through a third-party vendor.

METHODOLOGY DETAILS

Method: We completed a general population survey with a sample of (n=1168) smart TV owners aged 25-60 located across the United States. Excluding our screener questions, our survey consisted of 33 questions in total.

Duration: ~One month, from screener definition to analyses and final deliverable

Key Screener Criteria:

Our screener included 9 demographic questions informed by LG, 7 contextual and behavioral questions, and one open response. Consistent with our qualitative round,

50% LG TV owners, 50% owners of other TV brands, who purchased at least one TV within the last two years

Participants also had a mix of streaming devices, smart systems and devices.

Participants reflected persona types already established at LG

Additional screener criteria included HHI, gender, employment, and popular US demographics for the brand

ABRIDGED LEARNING GOALS

Prioritizing our Jobs-to-be-Done:

What are the most important jobs Smart TVs?

What’s the most high-value problem to solve for LG TV owners?

What UX concepts should we develop that we can iterate and test?

Fortifying our Insights:

On the whole, do owners feel their TV is personalized?

Are there sizable productivity-based value propositions worth pursuing related to working from home?

How important is voice for both the TV and around the house?

KEY SCALED LEARNINGS

While our entire survey focused on a broad set of smart TV needs, our most compelling learnings brought us back to one of our original qualitative insights—that the smart TV has one main job.

As you can see below, although the market ultimately wants more from their smart TVs, owners simply want to find relevant content faster. Additionally, global search across all streaming apps was most important, and four of the top five needs were concentrated on getting to the right content quicker.

NEXT STEPS

With our insights in mind, we delved into workshopping mode with our client team to polish 3 concept statements abbreviated below, and I facilitated a research-led design sprint with iterative prototype testing to bring them to high visual fidelity.

North Star Product Vision: an ultra-personalized hub that collects your most used content and platforms on your TV

Membership Objective: a way for LG to serve their own content and products via the TV

Companion Remote: an app managing play back, content searching and content management

ITERATIVE CONCEPT TESTING

We translated these statements to clickable mobile prototypes via a research-led design sprint with our internal Heady team, and I designed an iterative concept test and discussion guide based on our client needs, as well as our design team’s questions about these three new experiences, incorporating feedback from all stakeholders.

METHODOLOGY DETAILS

Method: We conducted a open qualitative study of moderated user interviews with (n=13) LG smart TV owners

Session Duration: 60 minutes

Time in-field: 2 weeks

Key Screener Criteria:

All participants have LG TVs, and made at least one TV purchase within the last two years

Participants also had a mix of streaming devices in their homes, in addition to other smart systems and devices

Participants reflected persona types already established at LG

Additional screener criteria included HHI, gender, employment, and LG’s popular US demographics

ABRIDGED LEARNING GOALS

North Star Product Vision:

Does LG serve as a content aggregator or content provider in this new experience?

Does this shift the users’ relationship and expectations of LG?

Membership Objective:

Is this experience about taking content on the go?

How do users conceive of product placement?

Companion Remote

What are the basic needs from a remote?

Are there unmet needs from the current remote experiences that could be met with a digital experience?

RESULT

Overall, we found validation and viability for all three concepts, and a strong sense from users that this was a complete package that ultimately improves the smart TV user experience by “bringing everything together” in a more seamless way. We also accumulated myriad directional signals as to how to improve each experience, including iterative changes and adjustments to the product level value proposition.

I presented each phase’s insights and findings decks sequentially, and we maintained alignment through a series of workshops staggered throughout our engagement. Word spread of our human-centered design approach to new product development throughout LG, and the agency secured repeat business from different business units within LG’s global organization.

CASE STUDY 005

Redefining Ownership Experience: Articulating a North-Star Vision for Post-Purchase Experience

Client: LG

Relationship: Agency

Sector: Home Electronics & Connected Devices

Responsibilities: Foundational strategic research, live moderation, competitor research

Objective: Define a north-star vision for visual design, product strategy, and content strategy for post-purchase experience at LG, including owner accounts (myLG) and Support Experience, aptly dubbed “Ownership Experience”

Project Duration: 3 Months

Approach: I led a series of stakeholder interviews to articulate the scope of our challenge, and designed a flexible research engagement to address each challenge.

I designed a generative, foundational qualitative study to understand the relationship owners have to their favorite appliance brands via their accounts.

I used scaled learnings to build confidence in our insights and findings, size opportunities, and prioritize needs from the account & support spaces.

I leveraged competitor research with the best-in-class brands in similar or adjacent categories to understand what visual elements best serve the owners.

FOUNDATIONAL QUALITATIVE INTERVIEWS

First, I worked with the LG client team to define the recruitment criteria for our foundational qualitative study, and I facilitated recruitment through a third-party vendor. Together, we aligned on the following study design and learning goals.

METHODOLOGY DETAILS

Method: A blind qualitative study of moderated user interviews with a total of (n=21) appliance owners

Session Duration: 60 minutes

Time in-field: 2 weeks

Key Screener Criteria:

50% LG owners and 50% non-LG owners to ensure generative outputs.

At least two major products or appliances within the last 18 months.

An even mix of owners with smart and non-smart appliances.

Additional screener criteria included HHI, gender, employment, and popular US demographics for LG.

LEARNING OBJECTIVES

Connected Appliances:

How do expectations for the owner account differ for owners with connected vs. non-connected appliances?

Shopping & Registration:

How does registration & suppport play a part in shopping? What values resonate in the context of brand loyalty?

Getting Support & Membership:

Paid and/or unpaid— what entices you?

Engagement & Utility

How do we make owning an LG product a joyful experience and continue to make owners feel special?

KEY QUALITATIVE INSIGHTS 💡

Our foundational qualitative study unearthed 4 major theme areas, 9 key insights, and 3 key learnings I surfaced with LG. We made recommendations for new product strategy & new content strategy to improve the value of registration and the LG owner account & the Support offerings from an owner perspective.

We identified three unique dispositions toward connected appliances

Owners are paying attention to the brand’s appetite for social good, and how their products impact both the environment and their own bills.

We identified key value propositions for account creation and product registration.

We found initial validation for community-based support, where owners can self-service with the help of other product owners.

From here, we turned to quantitative methods to scale our findings and help prioritize our product & content strategies.

QUANTITATIVE RESEARCH

Next, I designed a survey to scale our insights and learnings and prioritize the different opportunities we identified in our qualitative research. This helped us answer what is most meaningful to current and future owners.

METHODOLOGY DETAILS

Method: We completed a general population survey with a sample of (n=1035) home electronics and appliance owners aged 25-60 and located across the United States.

Duration: Our survey efforts unfolded over the course of ~1 month

Key Screener Criteria: Our screener included 11 demographic and behavioral questions.

50% of participants owned at least one LG appliance and 50% owned no LG appliances

All participants made a major appliance purchase within the last 18 months.

Household income was above 100K for all participants.

LEARNING OBJECTIVES

Connected Appliances

Are the 3 dispositions distinct scaled groups worthy of tailored content strategies?

Shopping & Registration

Of those identified through qual research, what’s the most compelling incentive for registration and account creation?

Getting Support & Membership

What can we learn about how Support can be improved from an owner perspective?

Product & Content Strategy

Do they want to see the product as a lifestyle match?

KEY QUANTITATIVE LEARNINGS 💡

I presented insights and learnings from our four key theme areas with the LG client team to help them prioritize their approach to product strategy & content strategy for myLG.

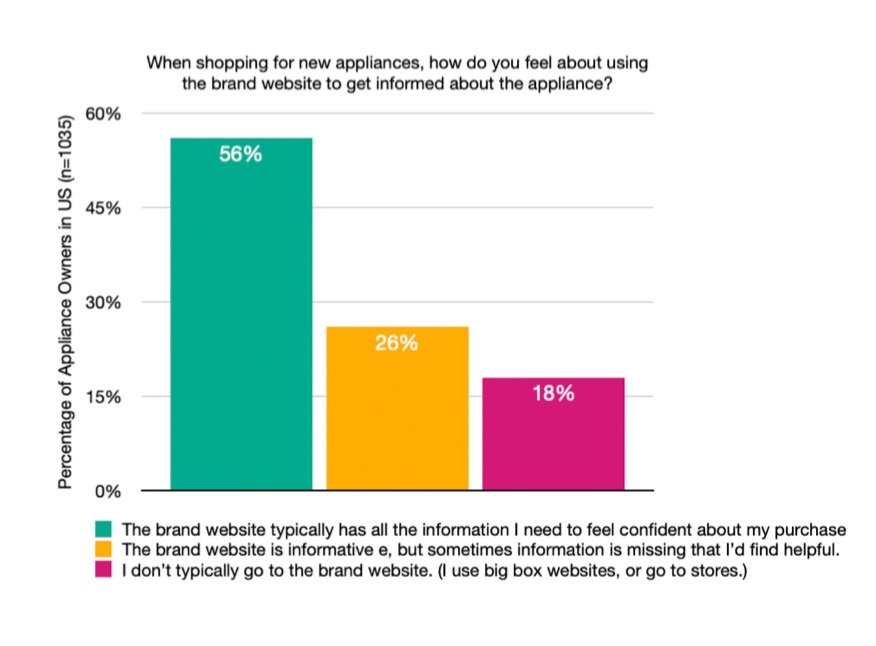

Shopping & Registration Needs

While we heard in qualitative research that the brand website is sometimes lacking relevant information, we found a concrete need to fill the gaps. We also identified the strongest value propositions for product registration.

Connected Home Appliances

Most critically, we validated our three distinct user types from qualitative research, and recommended to develop different content strategies for each group. We also confirmed that owners tended to mix appliance brands in their home, with only 10% intent on maintaining brand cohesion.

Support Behaviors & Needs

We confirmed the primary behaviors for seeking technical help for initial technical help, along with the best formatting for this type of information. We also learned that a whopping 80% of owners have crowdsourced help from owners of the same product, indicating a strong appetite for community engagement.

Product & Content Strategy Insights

Owners are especially turned into whether or not a product is a lifestyle match. I recommended take a more relational approach to digital strategy vs. the product focused approach that has become standard at LG. We also prioritized social causes that buyers identify with, so a a content strategy could be built out accordingly.

COMPETITOR RESEARCH

For our last phase of research and in the interest of speed, I leveraged unmoderated user interviews via Usertesting.com to evaluate (1) the owner account and (2) support experience offered by LG and the defined competitor brands.

Key Screener Criteria, All Studies:

Participants must have purchased from the brand being evaluated within the last 18 months, and registered it via the brand website.

All participants must be located within the US, aged 25-60, with a household income above $100K.

METHODOLOGY DETAILS: Study One, Track One

Approach: This track consisted of 20 participants, each of whom engaged 1 of 5 brands in isolation.

Key Tasks: Tell us about their recent purchase and describe and rate their satisfaction with the product, then, walk us through using the website to get product support, and rate the experience in terms of ease of use

METHODOLOGY DETAILS: Study Two, Track One

Approach: This track consisted of 16 participants who compared experiences from LG & one competitor.

Key Tasks: Share feedback on the product support hubs for LG and one competitor brand, and rate them for overall visual design and organization, then share feedback on a product support page from LG and one competitor brand, and rate them for intuitiveness and ease of use

METHODOLOGY DETAILS, Track Two

Approach: This track consisted of 30 users, each of whom viewed 1 of 5 brands in isolation

Key Tasks: Users are asked to locate the account space on the brand website and tell us what this space is for, then, to access it, and tell us how it aligns with their expectations. How do they conceive of this space? Secondly, they were asked to describe the account space from a visual design perspective, and tell us how about how intuitive the page feels, ease of use, and reasons for coming here.

KEY COMPETITOR LEARNINGS 💡

In our rating data for Study One Track One, we found that LG performed the worst in the context of getting their issue resolved. In Track Two’s rating data evaluating and comparing the existing support offerings, LG performed slightly better than Samsung and Bose, but worse than other brands in the study.

Altogether, we were able to hone in on design elements from each brand that were working well, and infuse them into our revamped experience.

Owners found LG’s support pages to be more visually overwhelming, but found value in the vastness of topics offered even without obvious organization.

Apple has standardized a product support journey, surfacing common topics at the top, followed by set up, maximizing value via product tips, and troubleshooting article topics.

Bose leveraged an icon carousel that filters topics accordingly, sure to surface most visited topics relevant to that category.

Samsung uses visual search in their product hub with optional text search, while LG relies on the model or serial number.

RESULT